The Charge/Reduce Revenue option allows administrators to simplify adjustments made to financial ledgers for families within the system. Using this method administrators can select what Type - Fee Valid Values can be setup in the system and have charge revenue.

Please Note: when setting up the Type - Fee Valid Values, the Revenue Adjustment Category must be selected.

NEW CONFIGURATION: If you have revenue adjustment categories setup and do not see them as options on the Charge/Reduce revenue screen please be sure the Use Revenue Tracking Dates field on the Setup > System Config > Statement screen is set to Yes.

Charge Revenue

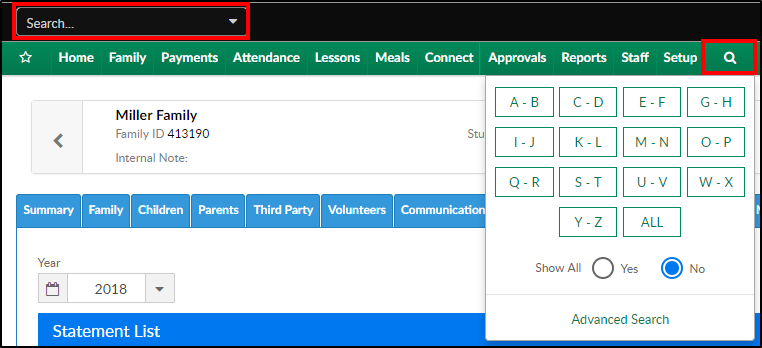

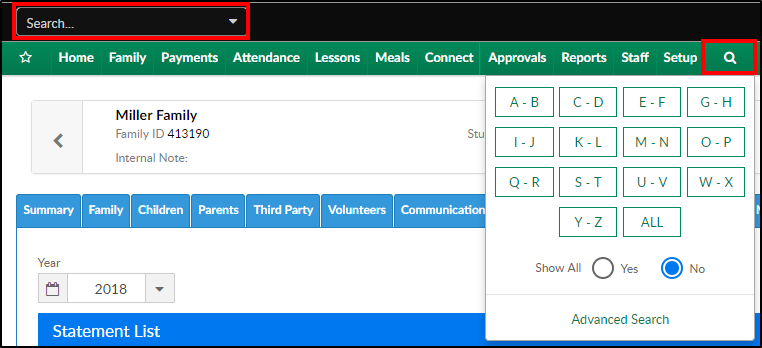

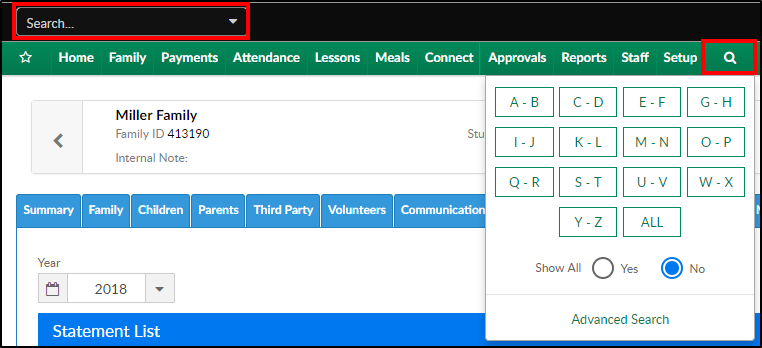

- Search for the family by entering the last name into the Search box or using the magnifying glass

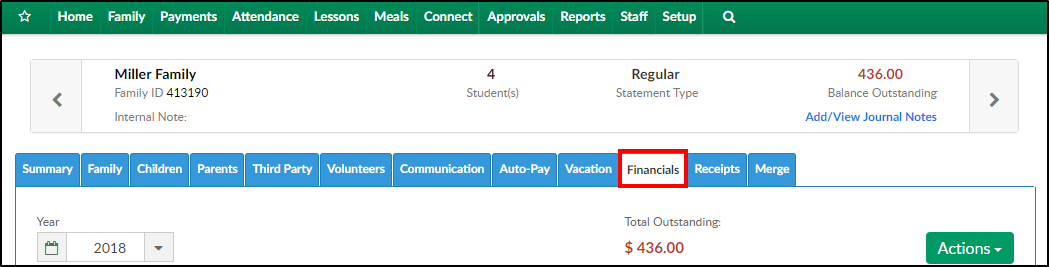

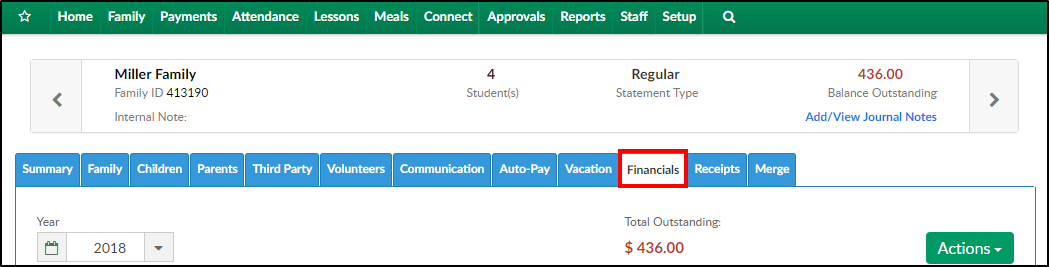

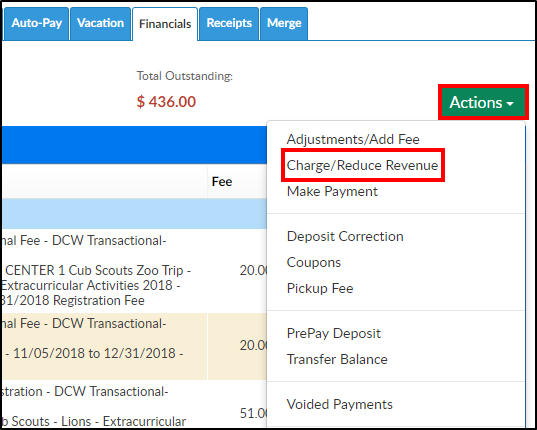

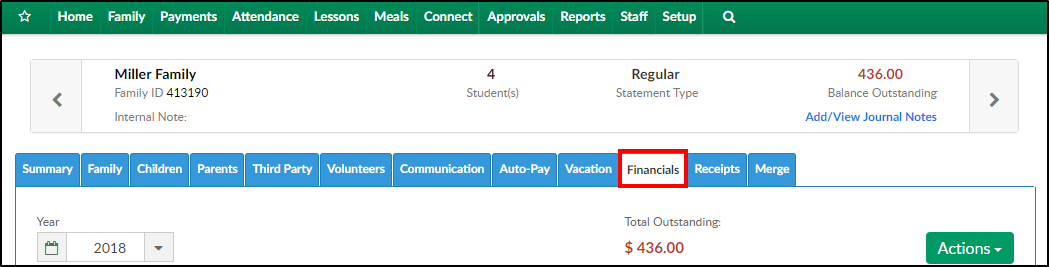

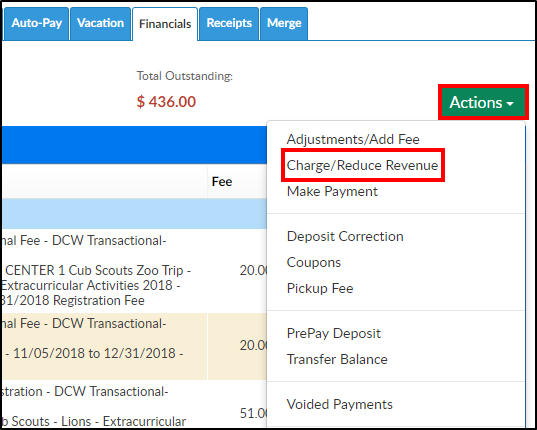

- Select the Financials tab

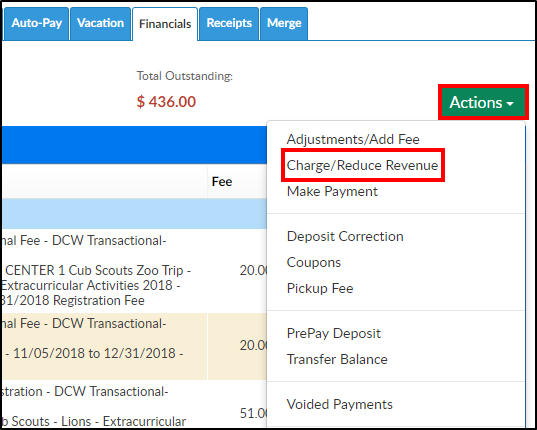

- The click Actions and select Charge/Reduce Revenue

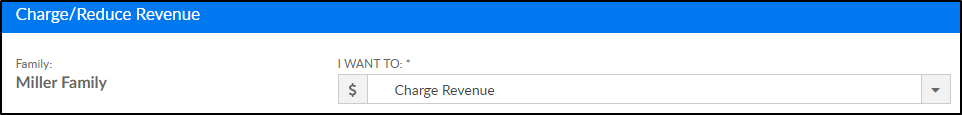

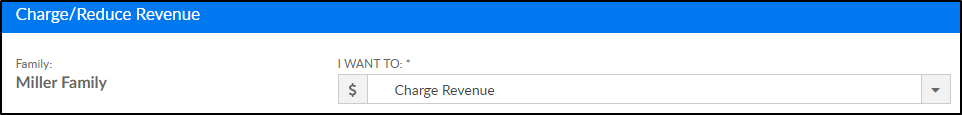

- Select Charge Revenue from the I WANT TO drop-down

- Adjustment Type - select the adjustment type from the drop-down menu

- Adjustment Amount - enter the amount of revenue to be charged

- Student/Child - select the student the revenue will be charged to

- Post Date - select the post date

- Post Against Classroom - select the classroom the revenue will be charged to

- Notes - enter an additional notes

- Period - From/To Date - select the period for the charged revenue

- The Summary section will show the balance before and after the adjustment

- Click Save

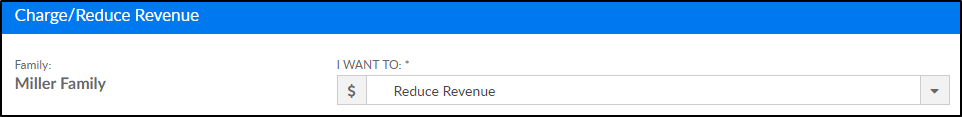

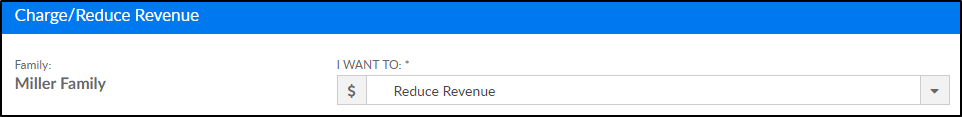

Reduce Revenue

- Search for the family by entering the last name into the Search box or using the magnifying glass

- Select the Financials tab

- The click Actions and select Charge/Reduce Revenue

- Select Reduce Revenue from the I WANT TO drop-down

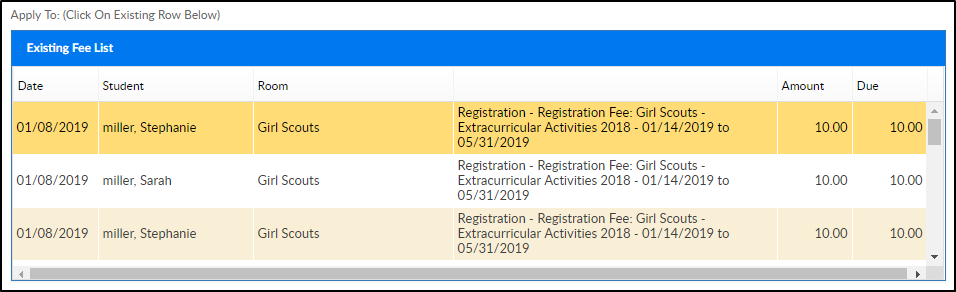

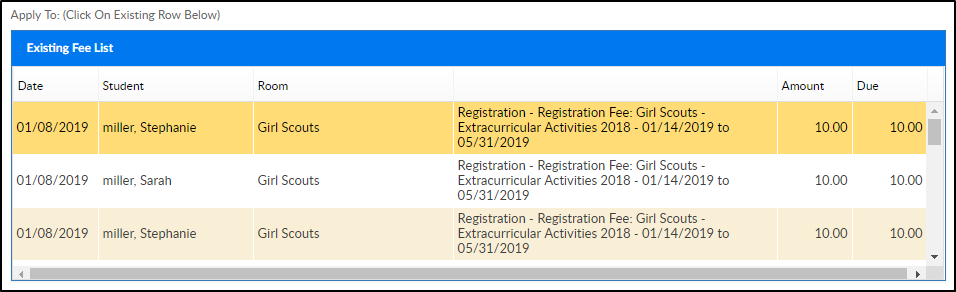

- In the Existing Fee List, select the row to associate the reduced revenue to

- Adjustment Amount - enter the amount of revenue to be reduced

- Student/Child - the student's name, from the selected line above, will appear in this field

- Post Date - select the post date

- Notes - enter an additional notes

- The Summary section will show the balance before and after the adjustment

- Click Save

Write-Off Family Bad Debt

Click here for more information