At the start of the new year most clients will choose to send year end tax statements to their families. Tax statements provide a summary of payments made by families. Ensure the payment type valid values are setup correctly.

Administrators can print tax statements or send tax statements to parents through the system via email. Please follow the steps below to print tax statements. Please Note: This can only be done for one center at a time, it does not work for the business level.

Printing Tax Statements - PDF

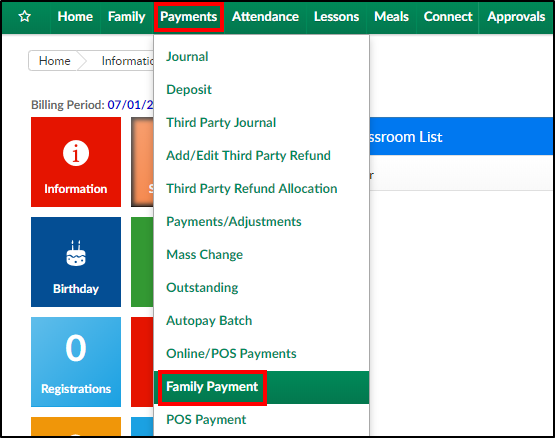

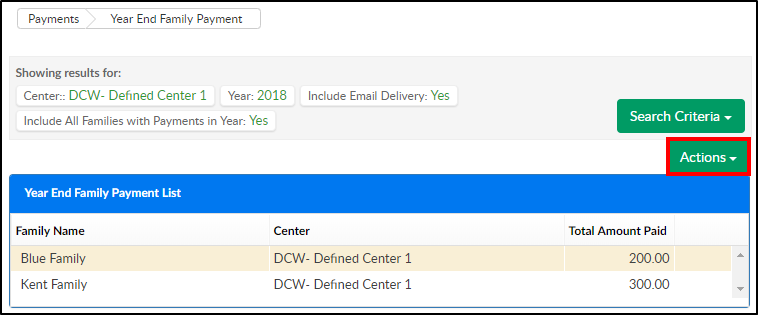

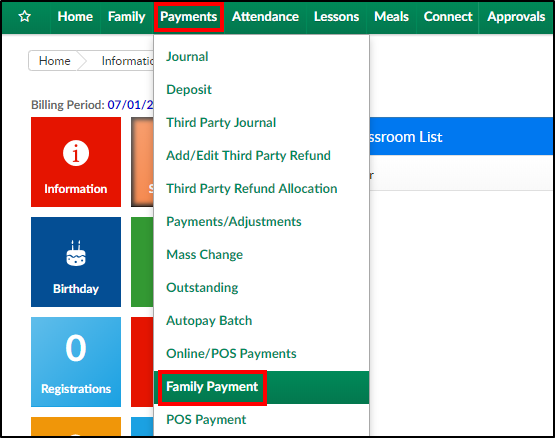

- From the Payments menu, click Family Payment

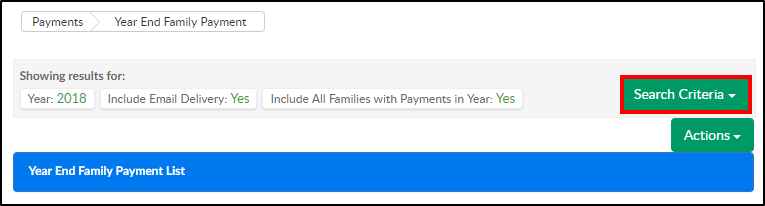

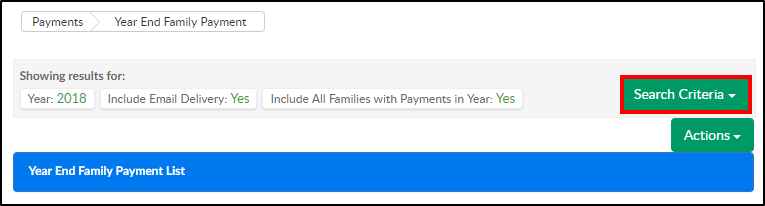

- Click the Search Criteria button

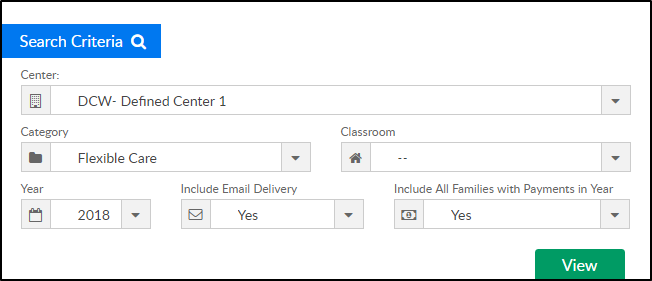

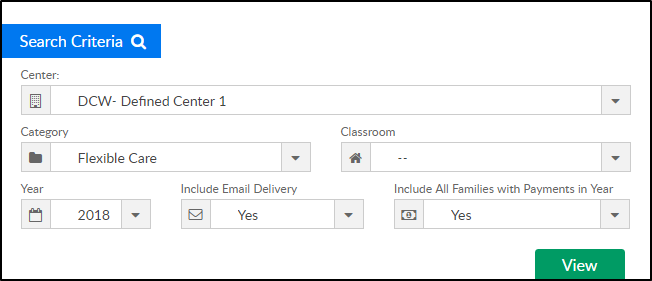

- Complete the Search Criteria fields

- Center - select the center from the drop-down. Selecting the Business Level will not populate information

- Category - choose a category, if applicable

- Classroom - choose a classroom, if applicable

- Year - select the year to view

- Include Email Delivery - Recommended Setting: Yes

- Include All Families with Payments in Year - Recommended Setting: Yes

- Click View

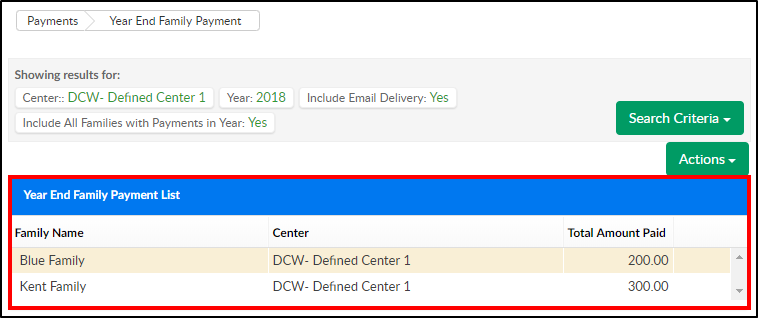

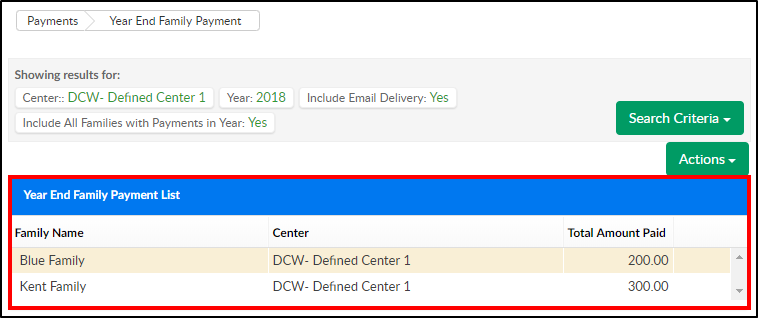

- Results will display in the Year End Family Payment List section

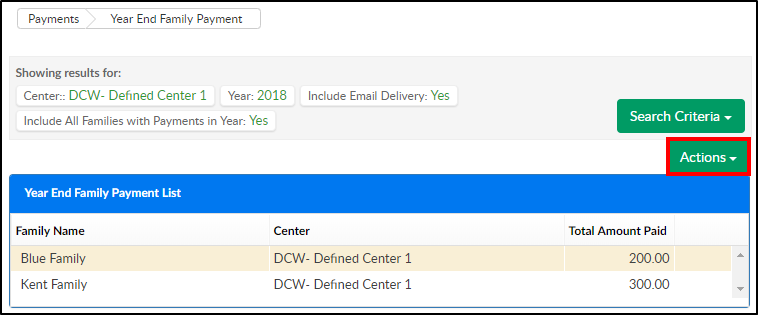

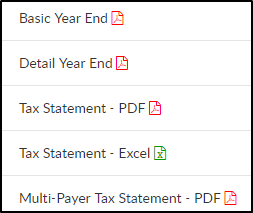

- To print statements, click the Actions menu

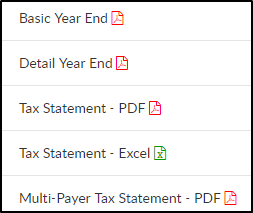

- Select one of the reporting options

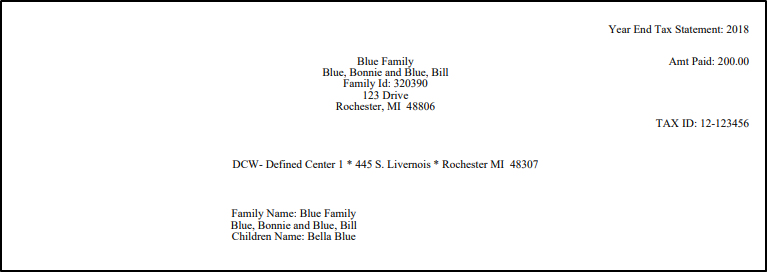

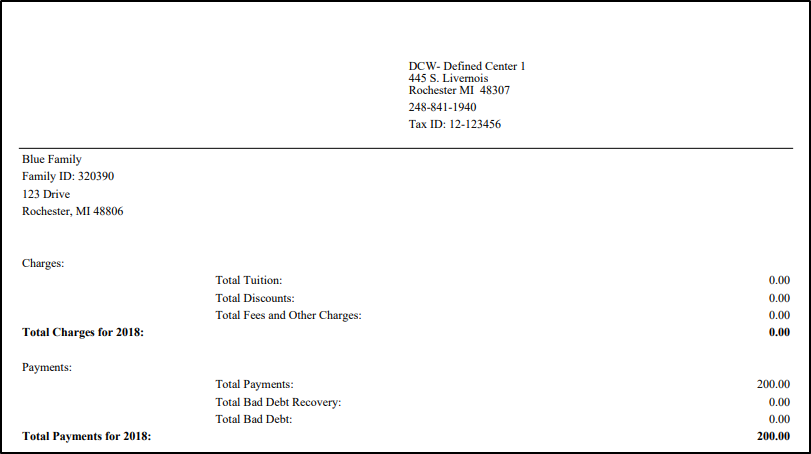

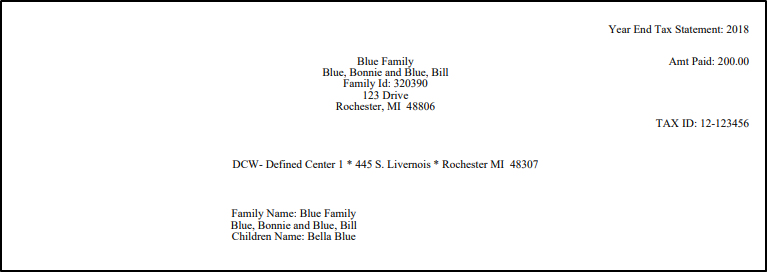

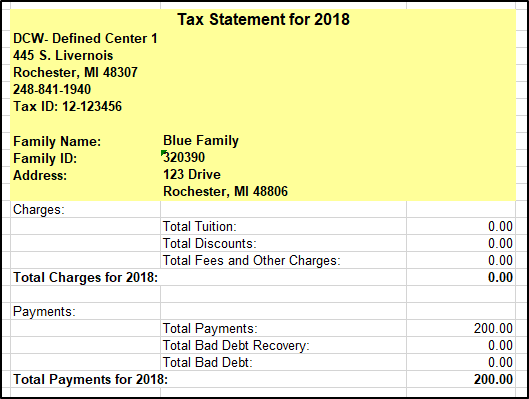

- Basic Year End - displays the paid balance in a sum

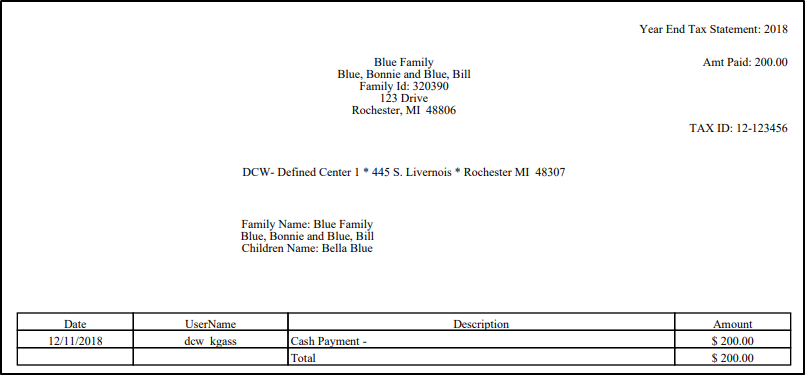

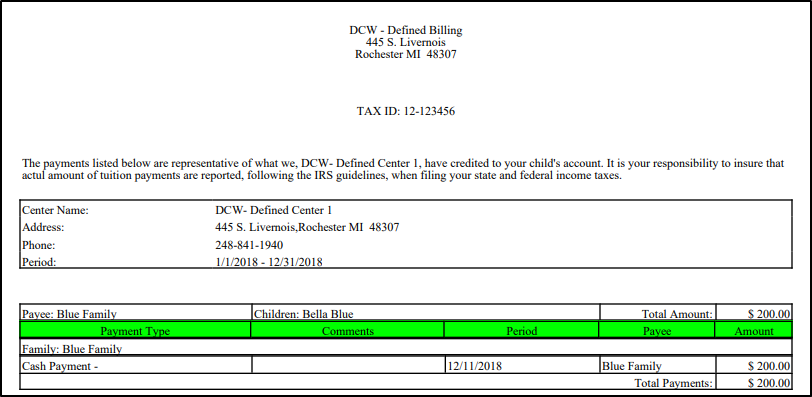

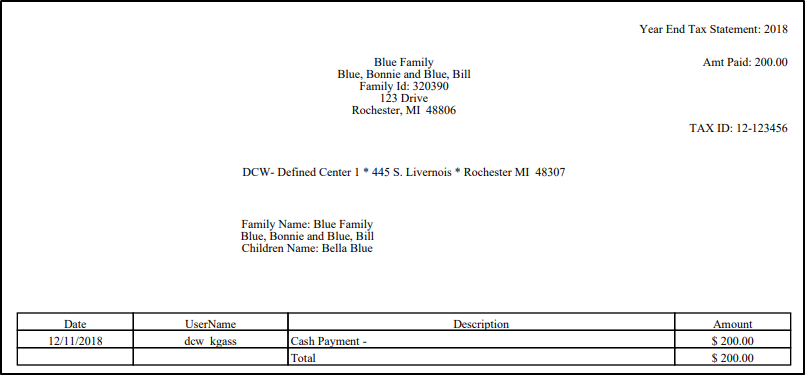

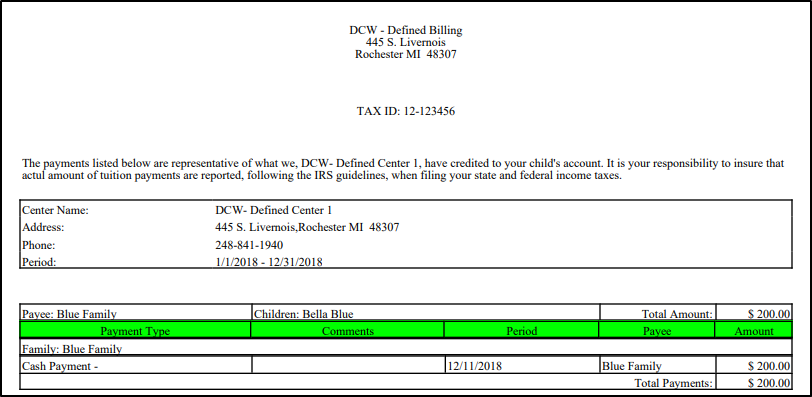

- Detail Year End - displays details of the paid balance

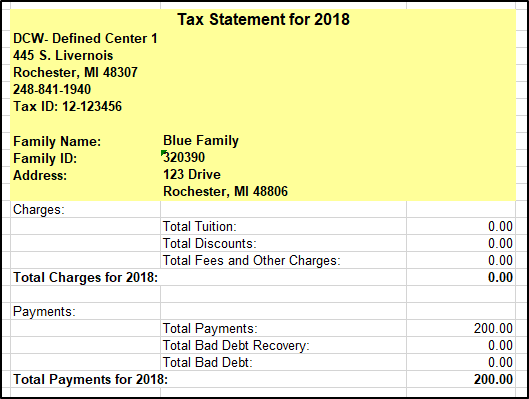

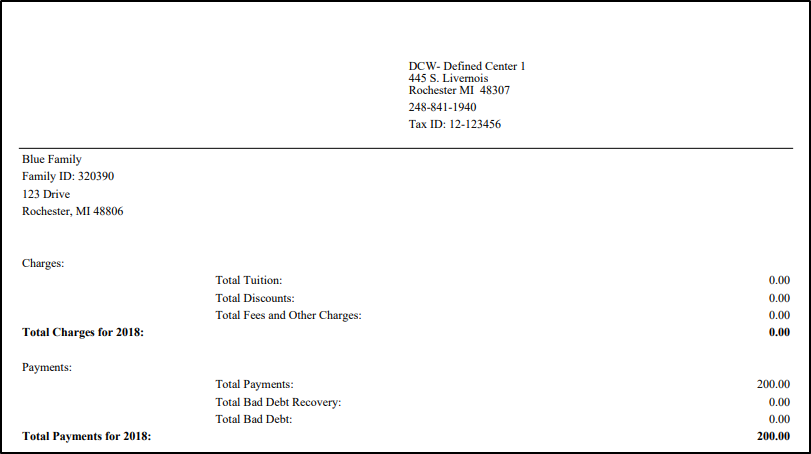

- Tax Statement - PDF - displays charges and payments in PDF format

- Tax Statement - Excel - displays charges and payments in Excel format with each family on a different worksheet. This option is best for internal use

- Multi-Payer Tax Statement - PDF - displays paid balanced by payer. This option allows for separation of balances paid within a single family

- This report can also be accessed via Reports > Financials. Select Misc in the Report Category and choose Multi Payer Tax Statement as the Report

- This report can also be accessed via Reports > Financials. Select Misc in the Report Category and choose Multi Payer Tax Statement as the Report

- Basic Year End - displays the paid balance in a sum