Setting up taxes in the system allows centers the ability to charge families taxes on registration and tuition for classrooms and events. These taxes can be associated to specific centers, states, brands, divisions, or districts based on ordinances.

- Click Setup from the menu, the select System Config

- Click Tax

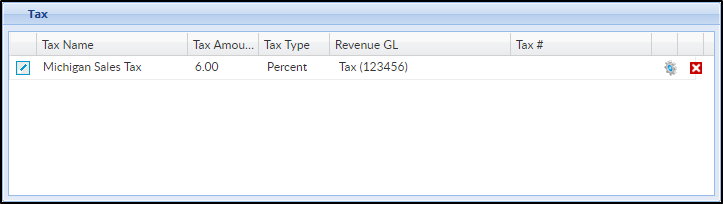

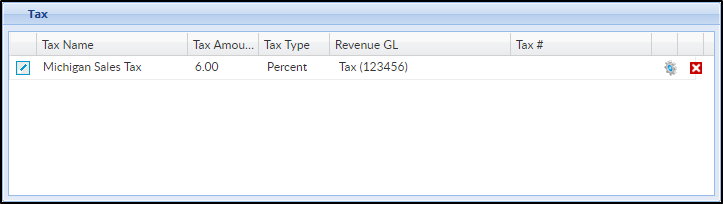

- View current tax information on the top portion of the screen. Please Note: if there is more than one tax setup in the system, the system will automatically select the first one in the list

- Click the edit icon on the left side of the row to edit the Tax List information

- Click the settings icon towards the right to Setup Tax Authorization

- Click the X to delete the tax information

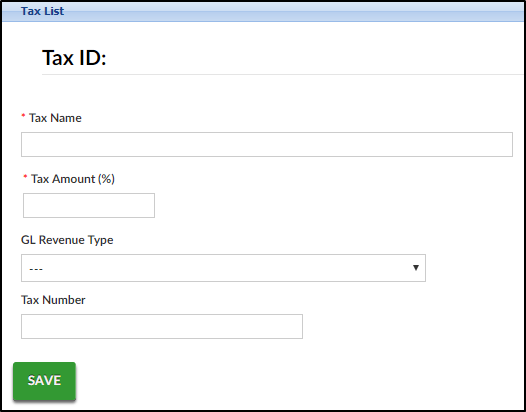

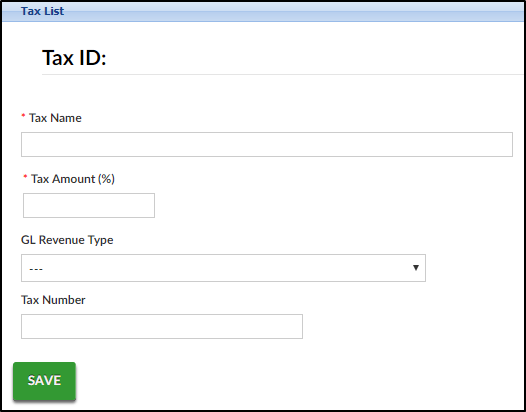

- To add a new Tax Id, complete the lower section of the screen

- Tax Name - enter the name of the tax

- Tax Amount - enter the amount of tax as a percentage

- GL Revenue Type - choose from the drop-down list

- Tax Number - enter the tax ID number

- Click Save

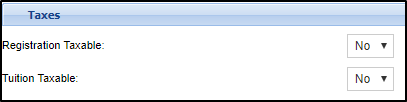

If registration or tuition for a program is eligible for taxes, follow the steps below.

- Once taxes have been setup, navigate to Setup > Room

- Click the name of the room you wish to add taxes to

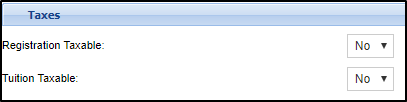

- Locate the Taxes section

- Registration Taxable - select yes is the registration for the classroom is eligible for taxes

- Tuition Taxable - select yes it the tuition for the classroom is eligible for taxes

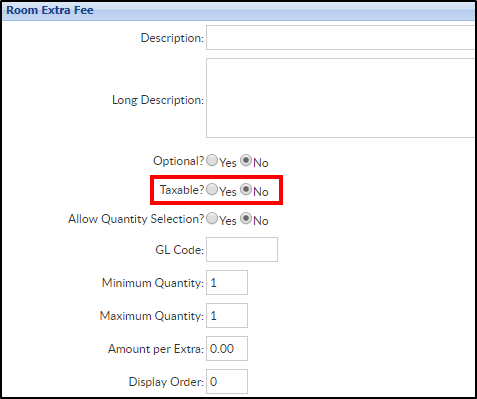

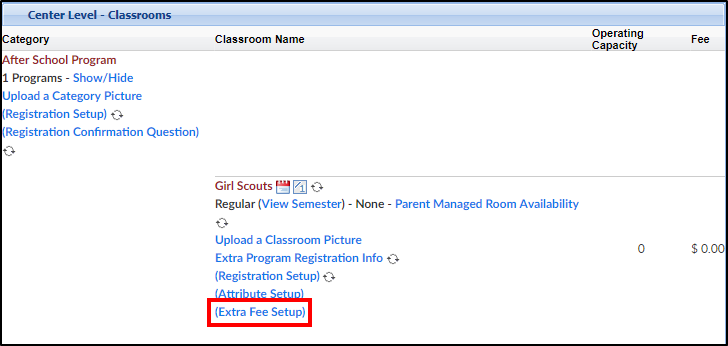

Taxable Extra Room Fees

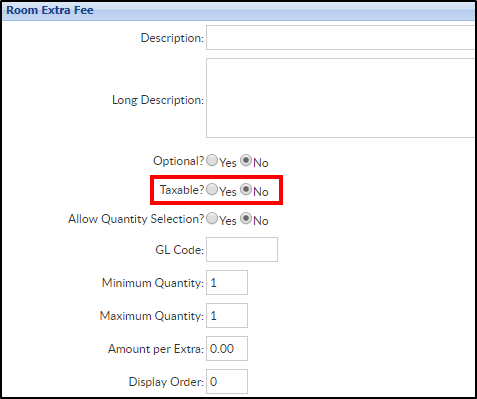

When setting up an extra room fee, there is an option to make it taxable.

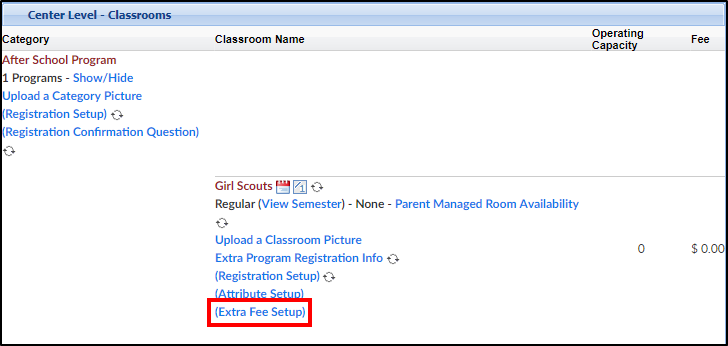

- From the Setup > Classroom screen, click Extra Fee Setup

- When completing the Room Extra Fee section, select Yes under Taxable so allow this fee to be taxable