At the start of a new year, most clients will choose to send year end tax statements to families. Tax statements provide a summary of payments made by families for the previous year.

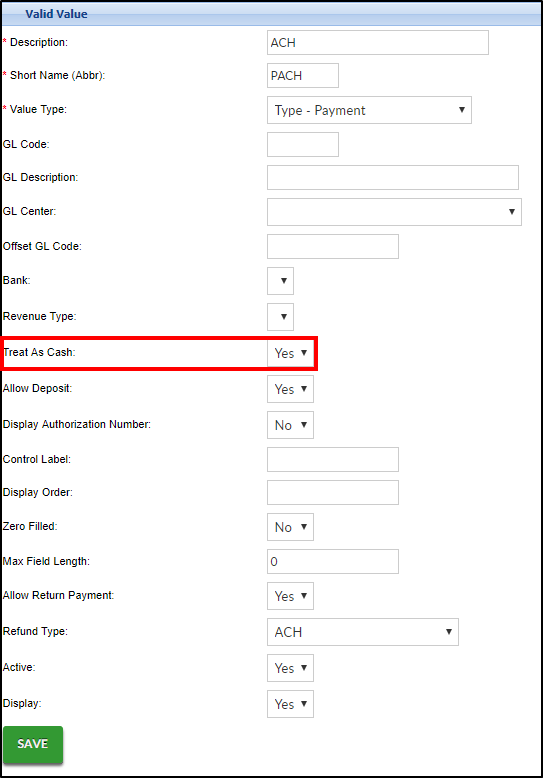

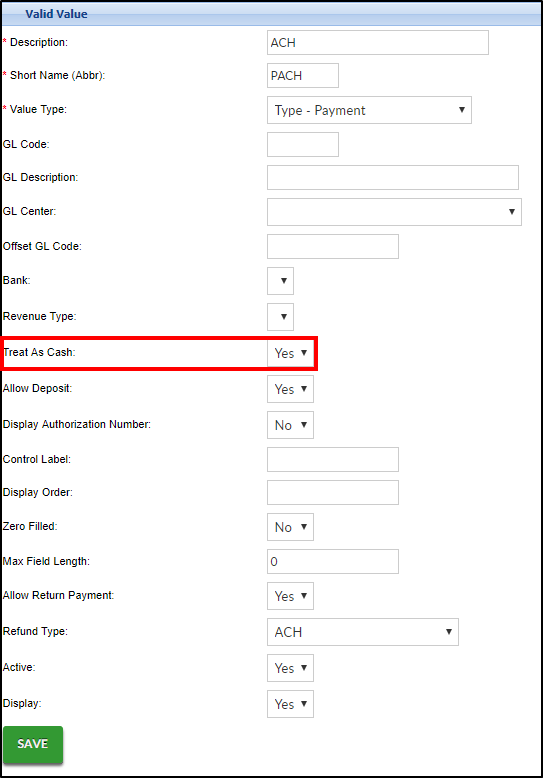

In order to ensure all valid payments have been included, clients should review the setup of their payment type valid values. If the payment type valid value is not set to “Treat As Cash” the payment will not be included on the tax statement.

Please Note: Some payment types like Third Party HOD or Scholarships should not be included on parent tax statements as the parent did not actually remit payment and should not claim the sum on their taxes.

Reviewing Payment Type Valid Values

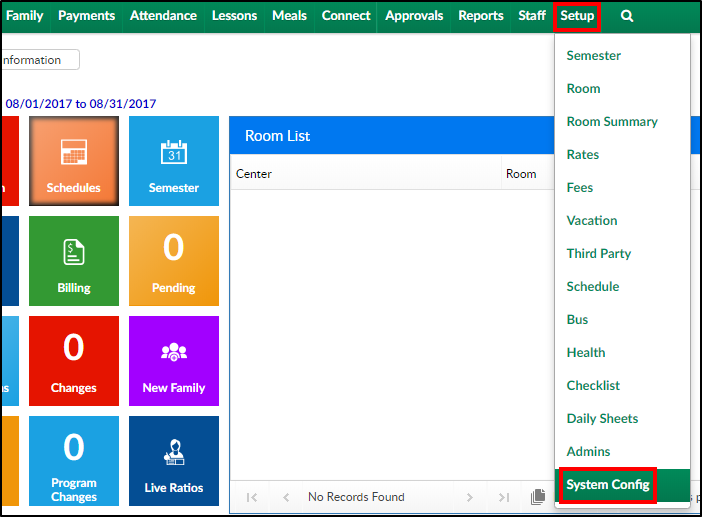

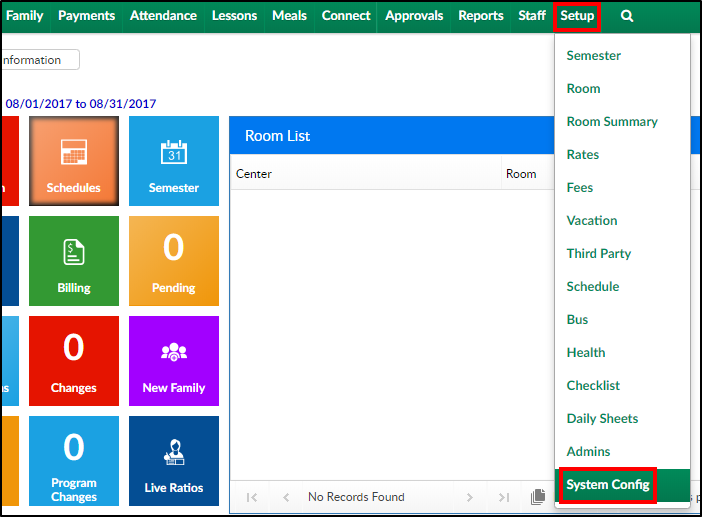

- Click Setup from the menu, then select System Config

- Click the Valid Values tile

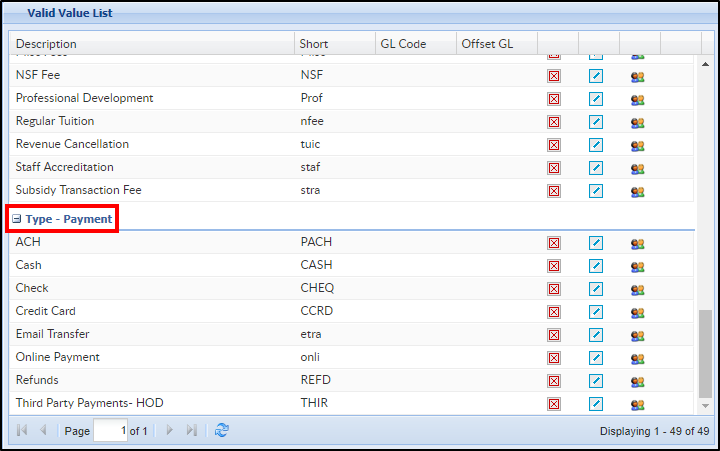

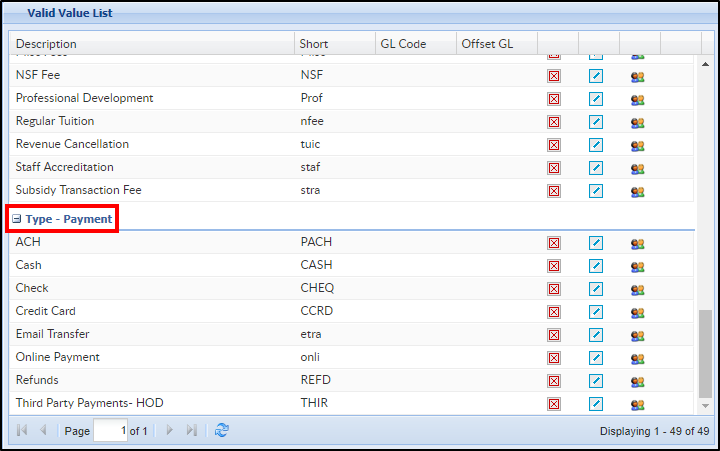

- Locate the Type - Payment title within the Valid Value List section

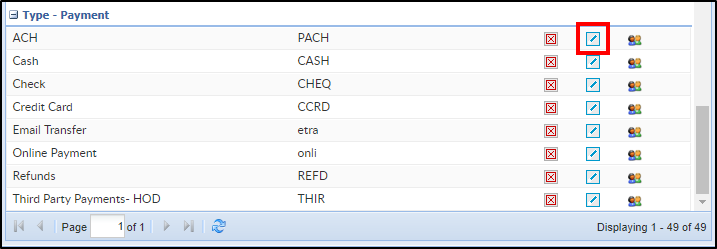

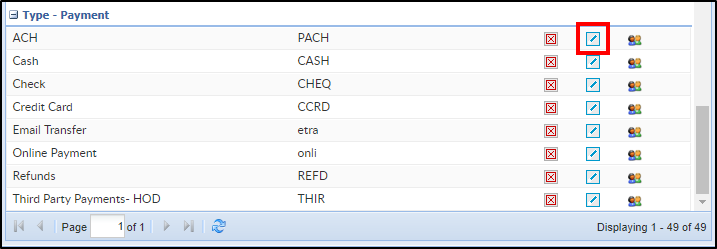

- Click the edit icon to view the payment type setup

- The setup of the payment type will display in the Valid Value section. Verify Treat As Cash is set to Yes if payments should display on the parent's year-end tax summary

- Click Save

Distributing Tax Statements

There are multiple ways to distribute tax statements to parents, click the links below for instructions.